Cloudy With a Chance of… Flooding!

Flood insurance has been an afterthought in most Americans’ minds when it comes to insuring property. Well, folks…the time has come for us to re-think the way we view flood insurance-more importantly, how we define and imagine flood. Here are some quick flood facts:

- Just one inch of water in a home can cost more than $25,000 in damage.

- Floods kill more than 100 people annually, which is more than any other single hazard.

- An individual flood claim averages more than $20,000.

- Without flood insurance, the only option for assistance with repairs would be to apply for federal disaster assistance.

- Federal disaster declarations are issued in less than 50 percent of flooding events. Federal disaster assistance typically comes in the form of a low-interest disaster loan, which must be repaid.

- Hurricane Harvey’s average grant from FEMA was $7,000, while the average National Flood Insurance Program (NFIP) claim was over $100,000.

“Rain, Rain, Go Away”

When a hurricane is approaching, the first thought about damage that comes to mind is damage from wind and coastal flooding. This could be damage to homes and businesses due to the heaviness of the flooding, which may result in commercial roofing companies in Denver, or wherever the flooding hit, to be called in so they can survey the area and remodel it so it is stronger and safer. Did you know that flooding is the most common, costly, severe, and deadly weather-related natural disaster in the country? Additionally, did you know that a property does not have to be near water to flood? As a matter of fact, if you live in an area with low or moderate flood risk, you are five times more likely to experience a flood than a fire in your home over the next 30 years! More than 20 percent of all National Flood Insurance Program flood claims come from outside of high-risk flood areas. Floods can result from storms, melting snow, hurricanes, drainage system backups, broken water mains, and changes to land from new construction, among other things.

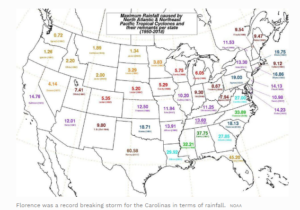

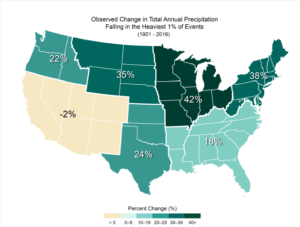

Heavy precipitation is becoming more intense and more frequent across most of the United States, particularly in the Northeast and Midwest. Extreme precipitation is related to climate change, due to a warmer atmosphere that can “hold” more water vapor, and therefore deliver more rainfall.

The Tides (and Sea Level) are Changing

Sea levels are rising. Regardless of what side of the “Climate Change” fence you’re on, there’s no denying that sea levels are rising and storms are becoming more frequent and volatile. Global sea level has risen approximately 7–8 inches since 1900, with about three of those inches occurring since 1993. The current rate of rise is a little more than an inch per decade. To take that a step further, take a look at how this has impacted the Northeast specifically:

- The Northeast has seen an increase in extreme precipitation, more than any other region in the United States. Between 1958 and 2010, the Northeast saw more than a 70 percent increase in the amount of precipitation falling in heavy weather events.

- Between 1895 and 2011, temperatures in the Northeast have increased by almost 2˚F (0.16˚F per decade), and precipitation has increased by approximately five inches, or more than 10 percent (0.4 inches per decade).

- Global sea levels are projected to rise 1 to 4 feet by 2100.

- A sea level rise of two feet, without any changes in storms, would more than triple the frequency of dangerous coastal flooding throughout most of the Northeast.

Preparedness & Recovery

The most important thing you can do in the event of a flood or flash flood is to avoid the impacted areas. You may also need to keep in touch with experts who could help you Get the best in water damage restoration. Our familiarity with rain and water creates a different risk perception, but it should not be taken lightly. We have a tendency to overlook and internalize what 20+ inches of rain would look like in our daily activities, since it’s something most of us have never experienced. However, when you find yourself in a flash flood or flood area, you can take these helpful measures to avoid further loss of property or life:

- Use USGS’s WaterAlert system (http://maps.waterdata.usgs.gov/mapper/wateralert) to receive texts or email messages when a stream in your area is rising to flood level.

- Regularly clear debris from gutters and downspouts.

- Store copies of irreplaceable documents (such as birth certificates, passports, etc.) in a safe, dry place. Keep originals in a safe deposit box.

- Build an emergency supply kit. Food, bottled water, first aid supplies, medicines, and a battery-operated radio should be ready to go when you are.

- Move furniture, valuables and important documents to a safe place.

- Reduce the risk of damage from flooding by elevating critical utilities, such as electrical panels, switches, sockets, wiring, appliances and heating systems.

- Turn Around, Don’t Drown: We assume that the amount of water on the road we travel everyday isn’t that bad and that it is surely passable. However, it seems that in every storm that brings flooding, there are videos of cars stalling in that seemingly passable road that need to be rescued.

On Saturday, April 28, 2018 – 10AM to 2PM local time, communities will team up with law enforcement to host the next National Prescription Drug Take-Back Day. You can call the Drug Enforcement Agency’s (DEA’s) Registration Call Center at 1-800-882-9539 or check the DEA’s website for collection sites in your area. The website will be continuously updated with new take-back locations.

On Saturday, April 28, 2018 – 10AM to 2PM local time, communities will team up with law enforcement to host the next National Prescription Drug Take-Back Day. You can call the Drug Enforcement Agency’s (DEA’s) Registration Call Center at 1-800-882-9539 or check the DEA’s website for collection sites in your area. The website will be continuously updated with new take-back locations.