3 Tips for Building your Startup

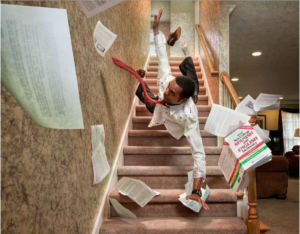

The first step is to come up with your business idea – now it’s time to build! In order for your new startup to be a success, you need spunk, determination and a strategy.

But where to begin?

From product, to employees, to clients, the responsibility can be overwhelming. We’ve put together a few of our tried-and-true tips to help you begin to successfully build your startup.

Networking is key

Identify your professional community and engage with it. Nowadays, you can successfully and efficiently network via social media platforms like LinkedIn. While this is a manageable day-to-day tool, we also suggest taking advantage of professional networking events for face-to-face interaction.

Networking also entails meeting the right people who can help you launch your business. The benefit of having strong connections is that they can turn into powerful allies.

When you interact with people who are already running a successful business, you may be able to gain a better understanding of the funds and number of shares to authorize that can satisfy investors, and you can offer to your future employees.

Find a balance

A startup is very demanding and can eat up the bulk of your time; however, it is important for you to give yourself (and your employees) a break. There is a reason Google’s offices have Ping-Pong tables, basketball courts and rock climbing walls. These activities help people expand there minds and think outside the box.

Moreover, bonding with employees outside the office can be essential to a company’s success. Mutual respect outside the office will transfer to exist inside the office and ensure that everyone feels safe in the work environment.

Ask questions

Even though you’re the boss, don’t feel like you need to have all the answers right away. Ask questions to people you trust.

People love to share their own experiences. Particularly at Cleary, we are happy to help with your startup questions and provide information about the various types of coverage that would be most beneficial for you.