Department of Family and Medical Leave – Update

The Department of Revenue recently released important information on how to report PFML Wages for the 4th Quarter 2019 Paid Family and Medical Leave Return. The Department of Family and Medical Leave is providing this update for all employers participating in the Commonwealth’s PFML program to ensure an accurate filing of withholdings by the quarterly deadline of January 31, 2020.

PLEASE BE AWARE THAT THIS REPORTING REQUIREMENT DOES NOT APPLY TO EMPLOYERS THAT HAVE RECEIVED AN EXEMPTION FROM BOTH THE FAMILY AND MEDICAL LEAVE PROGRAMS OR ARE CONSIDERED EXCLUDED EMPLOYMENT PER SECTION 6 OF THE UNEMPLOYMENT STATUTE.

IF YOU HAVE ONLY RECEIVED AN EXEMPTION FOR ONE LEAVE PLAN, YOU MUST SUBMIT FOR THE NON-EXEMPTED PLAN, ACCORDING TO THE INFORMATION PROVIDED BELOW.

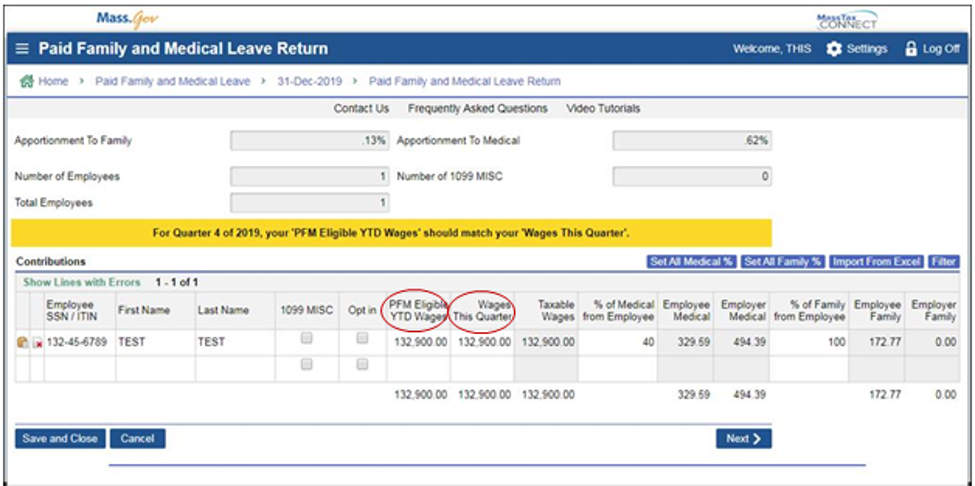

When reporting 2019 PFML contributions, please report fourth quarter wages only in both the PFM Eligible YTD Wages and Wages This Quarter boxes on the MassTaxConnect return. For the calculation to be correct, do not report actual 2019 year-to-date wages in the PFM Eligible YTD Wages box.

The reason for reporting only fourth quarter earnings in the PFM Eligible YTD Wages box is that contributions were not withheld for the first three quarters of 2019, so the Social Security annual wage cap should only be applied against fourth quarter wages.

This will only be necessary for this first PFML reporting as contributions were not withheld on all 2019 wages. When submitting future returns, you will report the actual YTD wages in the appropriate box.

IF YOU HAVE BOTH W-2 EMPLOYEES AND INDEPENDENT CONTRACTORS, BUT YOU OUTSOURCE ONLY W-2 PAYROLL SERVICES TO A THIRD PARTY

Important information about the timing of reporting

If your company outsources only W-2 payroll services to a third party, and handles reporting for your independent contractors (whose payments are reported on 1099-MISC) internally, there are some rules to follow when filing returns. It’s very important that the reporting be done in a specific sequence for it to be processed correctly.

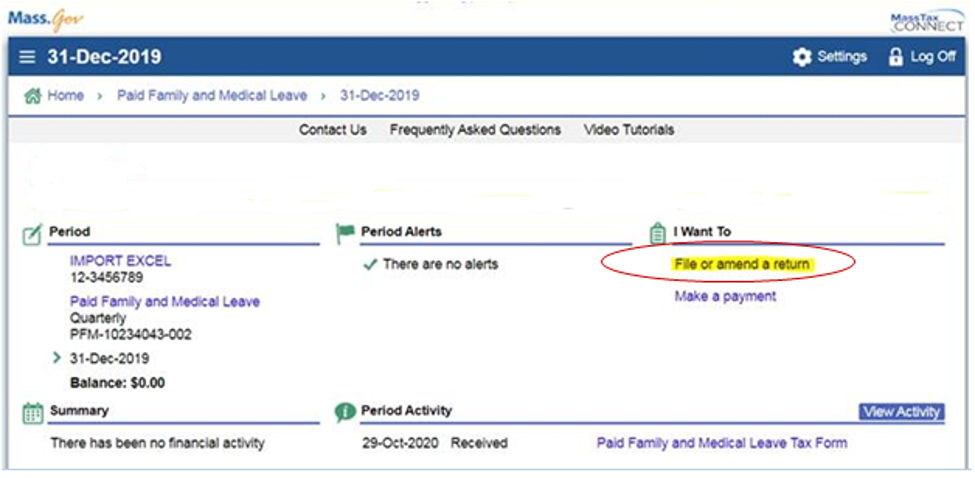

First, the payroll service, filing on behalf of your salaried employees (W-2s), must file before you file on behalf of your “covered contract workers” (1099-MISCs covered under the PFML Statute). Next, when you file on behalf of your covered contract workers, you must identify your filing as an amendment to the return already filed by your payroll service (see screenshot below). Please follow this sequence to be certain the information is properly recorded.

MORE INFORMATION

The Department of Family and Medical Leave oversees the Commonwealth’s Paid Family and Medical Leave program. Check out their website for a fact sheet, guides and information for both employers and workers.

You will find more information on exemption requests, registration, contributions, and payments for the Paid Family and Medical Leave program from the Department of Revenue.