Introducing the Driver Verification System

Presented by: Christopher F. Hawthorne, CPCU, CIC

A new tool has arrived to help business owners in reducing their Commercial Auto exposure risk. A basic for any driver is to have a valid license. Privacy laws and a very cumbersome Registry of Motor Vehicles inquiry system have been hurdles for business owners trying to carefully monitor their employees that drive as part of their job.

To help achieve the goal of having a safe driving workforce, the Massachusetts Registry of Motor Vehicles has introduced the Driver Verification System (DVS). The DVS allows a business to track changes to the license statuses of the business’s employees/drivers. Once a business has signed up for this no-cost program, the DVS will email the business owner a notification from the Mass DOT’s Registry of Motor Vehicles when there is a change in an employee’s license status such as the license being expired, suspended or revoked.

When an employee drives as part of their job, they may not inform the employer of a loss of license. The employer may learn of the lack of a valid license after a significant loss. The DVS puts the employer in the position of catching this situation immediately.

When notified, the business owner logs into their DVS account to view the driver/s that have a status change. The employer immediately is able to address the situation with the employee and take corrective action to protect the financial and reputational well-being of the business or organization.

Additionally, the DVS allows the business owner to then order driving records for any driver enrolled in the DVS program for the cost of $8 per Public record and $20 for a Personal record. (A public driving record excludes any not responsible, disqualified, and expired infractions or violations and also will exclude drug convictions (except for drug trafficking). A personal driving record is a complete history of the driver’s record including the excluded items above.)

The process for signing up for the DVS begins with:

- Writing a letter on your business letterhead stating your business need for using the DVS Program. This need can be stated as the business’s desire to have another risk management tool to make sure the business is operating in the safest manner for the public’s benefit.

- Submitting an “Agreement for Access to Records and Data Maintained by the Registry of Motor Vehicles”

- Submitting an “RMV Business Partner Contact Form”

- Submitting an “eServices Administrator Form”

Commercial Auto is a significant risk to all organizations that use either the organization’s autos or the employees’ personal vehicles. In either case, the employer will be named in a suit if there is bodily injury and/or property damage to others if the loss occurred in the scope of the employer’s business activity, be it a delivery or a sales call. With the advent of this tool, it would be understandable that the courts and juries will expect all employers to know their driving employees have a valid driver’s license. Therefore, implementing the DVS is recommended.

Other risk management tools available to an employer to reduce the chance of loss or limit the size of a loss are:

- Ordering a personal driving record for each driver annually.

- Implementing GPS tracking on company vehicles. Utilizing a GPS has been shown to reduce auto loss significantly as well as moon lighting and fuel savings.

- Distributing a company Driver Policy / Letter to all new employees and all employees annually. The policy will spell out the organization’s expectations for driving activity.

- Creating a file for each driver that contains an annual driving policy letter, a copy of the driver personal record, a copy of the employee’s personal auto coverage selection page, any Incident Reports, and any disciplinary actions taken to improve the driver’s attention to safe driving.

- Implementing an Accident Investigation Program to learn from each loss and to avoid repeating the loss in the future.

- Implementing Driver Training for all new employees as well as an annual update for all employees.

- Implementing a Vehicle Inspection Program where employees take the responsibility for periodically checking Tires, Wipers, Lights, etc. and documenting that they did so.

The auto loss exposure is prone both to frequency and severity. Time spent on the above risk management techniques can help reduce the odds of a loss or even the size of a loss. These efforts will pay dividends in low insurance premiums due to lower losses. For assistance with any of the above please contact us.

To begin the process of implementing a DVS, please go to: http://atlas.massrmv.com/DriverVerificationSystem.aspx.

Completed documentation and questions can be directed to Kristen.hagan@state.ma.us.

Intentional Violence and Insurance

Presented by Christopher F. Hawthorne, CPCU, CIC

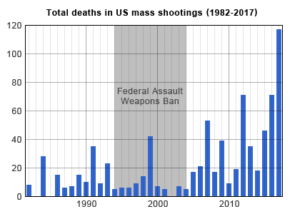

In 1966, a veteran—possibly suffering from PTSD—climbed into the watch tower at the University of Texas with a sniper rifle and proceeded to shoot and kill seventeen people, as well as wound another thirty-one. For ninety-six minutes, the nation watched what seemed to be an unimaginable, once-in-a-lifetime happening. This event was a total outlier to the norms of the United States. Surely, it would never happen again.

A few examples of 2018 mass shootings:

- February 14: Parkland, FL—17 killed & 14 wounded in a high school.

- June 28: Annapolis, MD—5 killed & 2 wounded at Capital Gazette.

- August 26: Jacksonville, FL—3 killed & 10 wounded at a convention for video game players.

- September 2: Birmingham, AL—1 killed & 6 wounded in a theater.

- September 28: Aberdeen, MD—4 killed & 3 wounded in a Rite Aid warehouse by an employee.

- October 27: Pittsburgh, PA—11 killed & 5 wounded in a synagogue during a service.

- November 7: Thousand Oaks, CA—12 killed & 11 wounded in a bar.

To date in 2018, there have been 323 mass* shootings in the US; in 2017 there were 346. That equates to 669 in the last 23 months, or an astounding 29 shooting per month. (*The Gun Violence Archive (https://www.gunviolencearchive.org/about) defines a mass shooting as a shooting in which four or more people are shot / injured.)

The shootings in Las Vegas (2017), Seattle (2015), Washington Navy Yard (2013), Aurora (2012), Virginia Tech (2007), Edgewater Tech, Wakefield, MA (2000), and Columbine High (1999) are almost distant memories, crowded out by ever-new stories. These events are so common that to many, they are a given and expected part of life. What was once unthinkable, tragically, is now commonplace.

The Federal Bureau of Investigation (FBI) reports that between 2000 and 2018, these violent outbreaks occurred in the following areas:

Places of Commerce 42%

Schools 21%

Open Spaces 14%

Government Offices 10%

Residences 5%

Places of Worship 4%

Healthcare Facilities 4%

48% of these cases show no known relationship between the assailant and location and/or victims. 21% are committed by an employee, while the remaining 31% are by students, group members and various other parties.

As business owners, community leaders, board members and risk managers, what does this mean to us and the financial wellbeing of our organization and communities? The scope of these events suggests that every organization should consider this as a risk.

If a mass shooting or workplace violence event did occur at your organization, what will the standard coverage in force today provide?

- If employees are injured while working, Workers’ Compensation will respond. The WC benefits will be inadequate.

- If property is damaged, property coverage will probably respond after the deductible is satisfied. Often property damage does not surpass the cost of a property deductible.

- If autos are damaged, Commercial Auto will probably respond under Comprehensive coverage.

- If the property owner or event organizer is sued for negligence, the General Liability might respond up to the limits in place.

After a shooting or a violent act, the typical insurance program is not designed to cover the following:

- An uninjured but severely traumatized employee cannot come back to work and is unable to earn income.

- Employees and the public no longer feel comfortable coming into a place of business leading to a period of income loss; a very long one, at that.

- Massive defense costs and liability settlements / judgements due to multiple deaths.

- Loss of reputation and the cost to rebuild it due to being associated with a heinous act compounding the business income loss.

- Wrongful Management Claims (Directors and Officers (D&O)) in that these types of events do not fall within the definition of wrongful management found in many Directors and Officers insurance policies.

Understandably, today’s insurance programs are not designed to cover these horrific losses. This change in the commonplace of our culture has exposed a weak point and unclear area of insurance coverage. The insurance industry is moving to clarify coverage. Exclusions should be expected to be written into most policies to clearly eliminate coverage for an intended violent act. In addition to exclusions, many coverage forms will begin to change the definitions in the policies as well. This also will eliminate coverage for these situations.

Therefore, just as it was appropriate to look to standalone Cyber coverage policy forms several years ago, it is now time to consider new standalone policy forms specifically designed to protect an organization from loss due to violent acts. Cyber coverage emerged with many different forms from many carriers, and now this coverage is considered “emerging.” In other words, there are many new policy forms and all of them are different.

In the evaluation of these forms, the following issues should be considered:

- Is the coverage location specific? (Event may occur offsite)

- Is the coverage weapon specific? (What if the instrument of destruction is a vehicle?)

- Is coverage limited to acts of terrorism or does it include all acts of violence?

- Does policy exclude acts of terror (TRIA) or include them?

- Is defense inside the limit of liability?Is the policy form designed to be “primary”?

- Does Business Income & Extra Expense coverage include an extended period of recovery?

- Does coverage respond to loss due to the threat of an event?

- Does the policy form include pre-loss Prevention and post-loss Control services?

- Does coverage include post-loss counseling and funeral expenses?

- Does policy provide training and drills?

- Does carrier have a Crisis Management Team at the ready?

- Does policy provide Security after an incident?

- Does policy provide post-loss Public Relations services and/or expenses?

What types of organizations should consider this type of specialty coverage? While all organizations could suffer this type of loss, the following are clear candidates:

- Religious organizations such as a Church or a Synagogue

- Schools

- Non-Profits (Special Events, Walks, Runs, Picnics)

- Businesses

- Government offices

- Healthcare facilities

- Entertainment operations

- Any organization with a Board of Directors

- Any business with chemicals as part of the processThe time has come to recognize this form of loss as a reality. From a small office in Wakefield, MA in 2000, to the tragic events in 2018, it is evident we all can suffer this type of loss and possible financial ruin. Specific policies are available to address this horrid peril. As with all risks, investing time in exposure analysis, loss prevention & control techniques, and considering / procuring insurance can mean the difference between an organization’s survival and financial destruction.

The new insurance programs can bring many services and coverages described above. In that the odds of this happening to any one organization are minimal, the premiums are on the lower end. While the odds and the premiums are low, the severity is enormous. As part of your organization’s program review, the time has come to include this sad aspect of our culture into our risk management and insurance planning.

Christopher F. Hawthorne, CPCU, CIC

Cleary Insurance, Inc.

chawthorne@clearyinsurance.com

Why Risk Transfer for Landlords?

Presented by: Christopher F. Hawthorne, CPCU, CIC

A property owner’s Insurance premiums can be driven upward for rental properties due to loss history. The insurance policy provides money to rebuild damaged property, to defend in a liability suit, to pay settlements as well as take care of employees when they are injured on the job. These combined costs are labeled as losses.

An insurance loss has the potential of driving insurance premiums up for four or five years as well as limiting which carriers will wish to work with a property. When an insurance carrier is determining what it will offer in terms of premiums, it will incorporate the prior four years of losses as part of the pricing mechanism. The fewer and smaller the losses, the more carriers will be interested and the lower the premiums can be offered.

An available risk management technique to lower the size of a property owner’s losses arising from the rental of that property is the inclusion of Risk Transfer language in the lease. Risk Transfer in the lease can protect the landlord’s insurance program and future premiums by transferring the cost of a loss to the tenant’s insurance program.

The major types of protection in risk transfer are:

Hold Harmless-Tenant holds Landlord harmless for a loss when Tenant has caused part or all of a loss.

Indemnify– Tenant agrees to reimburse Landlord for damages (settlements and judgments).

Defend– Tenant agrees to pay the cost to defend Landlord after a loss if Landlord is named in a claim or suit.

Additional Insured Status– Tenant provides coverage for Landlord under Tenant’s insurance program.

Primary Coverage-Tenant states that it’s coverage is primary should Landlord be brought into the suit.

Non-Contributory-Tenant states it’s policy disallows Landlord’s policies from sharing in the loss.

Waiver of Subrogation-Tenant disallows its’ insurance company from pursuing Landlord’s insurance carrier for any amount due to Landlord’s negligence that may have contributed to the loss.

In short, Landlord is highly protected by Tenant through contractual agreement in the lease as well as the tenant’s insurance program.

While not seen in all leases, the above language is quite commonly used and is a very easy risk management tool for a Landlords to implement. The rewards are lower losses, a well insured tenant and a greater number of insurance carriers available to offer coverage / lower future premiums.

It is critical to involve your attorneys as well as your insurance agents when drafting a lease. As always, a team approach and communication will put everyone is a better position to succeed and survive a loss.

Cloudy With a Chance of… Flooding!

Flood insurance has been an afterthought in most Americans’ minds when it comes to insuring property. Well, folks…the time has come for us to re-think the way we view flood insurance-more importantly, how we define and imagine flood. Here are some quick flood facts:

- Just one inch of water in a home can cost more than $25,000 in damage.

- Floods kill more than 100 people annually, which is more than any other single hazard.

- An individual flood claim averages more than $20,000.

- Without flood insurance, the only option for assistance with repairs would be to apply for federal disaster assistance.

- Federal disaster declarations are issued in less than 50 percent of flooding events. Federal disaster assistance typically comes in the form of a low-interest disaster loan, which must be repaid.

- Hurricane Harvey’s average grant from FEMA was $7,000, while the average National Flood Insurance Program (NFIP) claim was over $100,000.

“Rain, Rain, Go Away”

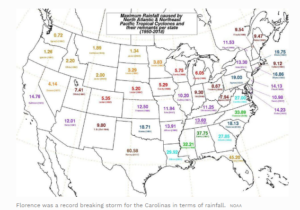

When a hurricane is approaching, the first thought about damage that comes to mind is damage from wind and coastal flooding. This could be damage to homes and businesses due to the heaviness of the flooding, which may result in commercial roofing companies in Denver, or wherever the flooding hit, to be called in so they can survey the area and remodel it so it is stronger and safer. Did you know that flooding is the most common, costly, severe, and deadly weather-related natural disaster in the country? Additionally, did you know that a property does not have to be near water to flood? As a matter of fact, if you live in an area with low or moderate flood risk, you are five times more likely to experience a flood than a fire in your home over the next 30 years! More than 20 percent of all National Flood Insurance Program flood claims come from outside of high-risk flood areas. Floods can result from storms, melting snow, hurricanes, drainage system backups, broken water mains, and changes to land from new construction, among other things.

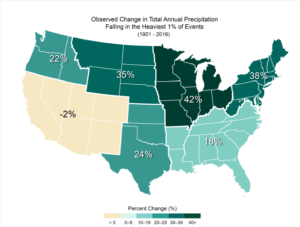

Heavy precipitation is becoming more intense and more frequent across most of the United States, particularly in the Northeast and Midwest. Extreme precipitation is related to climate change, due to a warmer atmosphere that can “hold” more water vapor, and therefore deliver more rainfall.

The Tides (and Sea Level) are Changing

Sea levels are rising. Regardless of what side of the “Climate Change” fence you’re on, there’s no denying that sea levels are rising and storms are becoming more frequent and volatile. Global sea level has risen approximately 7–8 inches since 1900, with about three of those inches occurring since 1993. The current rate of rise is a little more than an inch per decade. To take that a step further, take a look at how this has impacted the Northeast specifically:

- The Northeast has seen an increase in extreme precipitation, more than any other region in the United States. Between 1958 and 2010, the Northeast saw more than a 70 percent increase in the amount of precipitation falling in heavy weather events.

- Between 1895 and 2011, temperatures in the Northeast have increased by almost 2˚F (0.16˚F per decade), and precipitation has increased by approximately five inches, or more than 10 percent (0.4 inches per decade).

- Global sea levels are projected to rise 1 to 4 feet by 2100.

- A sea level rise of two feet, without any changes in storms, would more than triple the frequency of dangerous coastal flooding throughout most of the Northeast.

Preparedness & Recovery

The most important thing you can do in the event of a flood or flash flood is to avoid the impacted areas. You may also need to keep in touch with experts who could help you Get the best in water damage restoration. Our familiarity with rain and water creates a different risk perception, but it should not be taken lightly. We have a tendency to overlook and internalize what 20+ inches of rain would look like in our daily activities, since it’s something most of us have never experienced. However, when you find yourself in a flash flood or flood area, you can take these helpful measures to avoid further loss of property or life:

- Use USGS’s WaterAlert system (http://maps.waterdata.usgs.gov/mapper/wateralert) to receive texts or email messages when a stream in your area is rising to flood level.

- Regularly clear debris from gutters and downspouts.

- Store copies of irreplaceable documents (such as birth certificates, passports, etc.) in a safe, dry place. Keep originals in a safe deposit box.

- Build an emergency supply kit. Food, bottled water, first aid supplies, medicines, and a battery-operated radio should be ready to go when you are.

- Move furniture, valuables and important documents to a safe place.

- Reduce the risk of damage from flooding by elevating critical utilities, such as electrical panels, switches, sockets, wiring, appliances and heating systems.

- Turn Around, Don’t Drown: We assume that the amount of water on the road we travel everyday isn’t that bad and that it is surely passable. However, it seems that in every storm that brings flooding, there are videos of cars stalling in that seemingly passable road that need to be rescued.

National Prescription Drug Take Back Day

On Saturday, April 28, 2018 – 10AM to 2PM local time, communities will team up with law enforcement to host the next National Prescription Drug Take-Back Day. You can call the Drug Enforcement Agency’s (DEA’s) Registration Call Center at 1-800-882-9539 or check the DEA’s website for collection sites in your area. The website will be continuously updated with new take-back locations.

On Saturday, April 28, 2018 – 10AM to 2PM local time, communities will team up with law enforcement to host the next National Prescription Drug Take-Back Day. You can call the Drug Enforcement Agency’s (DEA’s) Registration Call Center at 1-800-882-9539 or check the DEA’s website for collection sites in your area. The website will be continuously updated with new take-back locations.

Consumers may also continue to utilize the guidelines How to Dispose of Unused Medicines as posted by the FDA if they are not able to attend a scheduled Take-Back Day.

DEA began hosting National Prescription Drug Take-Back events in 2010. At the previous 14 Take-Back Day events, millions of pounds of unwanted, unneeded or expired medications were surrendered for safe and proper disposal.

At the last Take-Back Day in October 2017 over 5,300 sites spread across the nation collected unwanted medications totaling over 900,000 pounds (456 tons). The disposal service is free and anonymous for consumers, with no questions asked. Keep in mind that needles, sharps, asthma inhalers, mercury thermometers, iodine-containing medications, and illicit drugs (including marijuana which is still a schedule 1 drug under federal law) are not accepted at the drop box.

Opioid abuse is at epidemic levels in the U.S., and a top public health concern. The DEA’s “Take-Back” initiative is one of several strategies to reduce prescription drug abuse and diversion in the nation. Additional strategies include providing the right medication assisted treatment solutions, education of health care providers, patients, parents and youth; establishing prescription drug monitoring programs in all 50 states; and increased enforcement to address illicit methods of prescription drug diversion. In 2018, the U.S. government allotted $4.6 billion in the federal budget towards the expanding opioid crisis.

The DEA’s Take Back Day events provide an opportunity for Americans to prevent drug addiction and overdose deaths. To find a collection site near you, please click here.

RMV Changes to the MA State Markings Regulation 540 CMR 2:22

There has been a change to the Massachusetts State Markings Regulation 540 CMR 2:22 (regulation text below) that will take effect on September 1, 2018 for all commercial motor vehicles that weigh 10,001 lbs. or more used in Intrastate commerce. The RMV changes could affect customers that are written on a Massachusetts Auto Policy class 30 such as plumbers, carpenters, electrician, etc.

The updated regulation affects the type and placement of vehicle markings and will also require any vehicle used in intrastate commerce to have a US DOT number. Affected vehicles include those that are:

- Engaged in intrastate commerce having a gross vehicle weight rating or gross combination weight rating of 10,001 or more pounds; or

- Used in the transportation of hazardous materials in a quantity requiring placarding; or

- Designed to transport more than 15 passengers including the driver, used in intrastate commerce in Massachusetts.

The Massachusetts State Police Truck team has been stopping people to let them know that by September 1, 2018, the USDOT numbers need to be filed with the Federal Motor Carrier Safety Administration (FMCSA) and visible on their vehicles. Click here for a copy of the notice that the State Police Truck Team is handing out.

The updated regulation language is as follows:

2.22: Markings on Commercial Vehicles

(1) Marking.

(a) Effective until August 31, 2018. The owner of every motor truck used for the transportation of goods, wares or merchandise for hire, gain or reward, shall have the owner’s name marked on the truck, to be plainly visible from each side or from the front and rear of the vehicle, provided that motor trucks operated under a lease of more than 30 days shall display either the name of the owner or the lessee, and may display both. For the purpose of 540 CMR 2.22(1), motor truck shall mean any motor vehicle specially designed or equipped to transport personal property over the ways of the Commonwealth and which has a maximum load carrying capacity of over 2,000 lbs., and which is not a Private Passenger Motor Vehicle under 540 CMR 2.05. To the extent there is any conflict between 540 CMR 2.22 and any federal regulation pertaining to markings on commercial motor vehicles, the federal regulation shall control.

(b) Effective September 1, 2018. The owner of every motor truck used for the transportation of goods, wares or merchandise for hire, gain or reward, shall have the owner’s name marked on the truck, to be plainly visible from each side, be in permanent letters that contrast sharply in color with the background on which the letters are placed; be readily legible during daylight hours from a distance of 50 feet while the motor truck is stationary; and be kept and maintained in a manner that retains the legibility required by 540 CMR 2.22(1)(b), provided that motor trucks owned or controlled by a farmer and used to transport agricultural products, farm machinery, and/or farm supplies to or from the farmer’s farm; not used in the operation of a common or contract carrier, and used within 150 air miles of the farmer’s farm need not be so marked; and motor trucks operated under a lease of more than 30 days shall display either the name of the owner or the lessee, and may display both. For the purpose of 540 CMR 2.22(1), Motor Truck shall mean any motor vehicle specially designed or equipped to transport personal property over the ways of the Commonwealth and which has a maximum load carrying capacity of between 2,000 lbs. and 10,000 lbs. and which is not a Private Passenger Motor Vehicle under 540 CMR 2.05. To the extent there is any conflict between 540 CMR 2.22 and any federal regulation pertaining to markings on commercial motor vehicles, the federal regulation shall control.

(2) U.S. DOT Number Assignment for Intrastate Carriers. Effective September 1, 2018, every motor vehicle engaged in intrastate commerce in Massachusetts having a gross vehicle weight rating or gross combination weight rating of 10,001 or more lbs.; and every motor vehicle regardless of weight, engaged in intrastate commerce in Massachusetts and used in the transportation of hazardous materials in a quantity requiring placarding; and every motor vehicle designed to transport more than 15 passengers, including the driver, used in intrastate commerce in Massachusetts must be permanently marked with a USDOT number assigned in a manner conforming to the provisions of 49 CFR 390.21.

(3) Penalty. The penalty for a violation of 540 CMR 2.22 is set forth in M.G.L. c. 90, § 20.

Click here for more information on 540 CRM 2.22

Leaving Home – Insurance Concerns

Presented by: Christopher F. Hawthorne, CPCU, CIC

When a child moves out of the home, it can be both exciting and heartbreaking. As one phase of life is ending, another wonderful one begins. However, the danger lurking within the parents’ home and auto insurance, as well as within certain privacy laws, can often be overlooked. Both home and auto policies have limitations that can leave a family vulnerable in terms of its financial wellbeing, and privacy laws can leave parents in the dark about their child’s physical wellbeing.

If a child is moving out to live with friends, they have, in effect, set up their own household. If a lease is present, it is clear that there is now a separate residence, even if the child is renting a unit owned by the parent.

If a child is in college, they are typically considered part of the household. However, if during college they rent an apartment outside of the dorm system, then they have created a separate household.

Addressing these issues will help secure the financial wellbeing and peace of mind for both the parents and the child.

Renters Insurance

While a person at this stage may not own much in the way of personal property, they still have much to lose. Along with personal property such as clothing and furniture, a Renters Policy (HO4) also provides liability protection. For example:

• While attending a cookout, a Frisbee flies off-course and lands at a person’s feet. They pick it up to toss it back to the thrower and when they do, the Frisbee misses and slashes someone’s eye. The injured party or their insurance company (health or disability) may come after the person who threw the Frisbee for compensation.

• While in an apartment, the renter starts a fire which causes significant damage. The roommates, neighbors and landlord may pursue the individual for compensation.

In addition, many leases hold the renter liable and not the landlord. Therefore, if a guest visiting the individual slips, falls, and is injured, for example, the renter will be the responsible party.

For those starting out on a bright career path, they may live in a state where future wages can be garnished. If this is the case, without renter’s insurance, the liabilities described above could cancel out much of the financial benefits of the bright career.

If parents or a trust financially support the renter, the injured parties might try to get to the parental or trust assets. Renters coverage will place a barrier between the parental assets that hopefully can pay for any liabilities and if there is a trust in play, the trust should be named as an Additional Insured on the renter’s policy.

If the lease is in the parent’s name, the parents Homeowners policy should be amended to extend coverage E to cover the new location.

Auto Insurance

In Massachusetts, once a child is no longer a resident of the parents’ home, they are no longer covered by the parents’ policy while driving vehicles not owned by their parents. If the child drives a rental car or a friend’s car, their financial wellbeing is at risk because they have no personal protection. In this situation, a Named Non-Owned Auto policy in the name of the child would be appropriate. A Named Non-Owned Auto policy is simply an auto policy without an auto listed and therefore has no Comprehensive and Collision coverage. If the child is driving a car provided by the parents, an alternative would be to retitle the car in the child’s name.

If the child is using a parent’s auto for work purposes such as delivery or Uber, it is critical to report this to the insurance carrier. Unreported commercial use can reduce the limits of protection to Massachusetts Statutory limits such as reducing Bodily Injury of Others from $250,000/$250,000 to $20,000/$40,000.

If the child takes the car out of the state, that must be reported as well to preserve the Comprehensive coverage for glass, theft, and vandalism.

Privacy

Once a person turns eighteen, a parent loses the right to know personal information about their child without the child’s permission. If a child is hospitalized, the hospital is not allowed to reach out to the parents or even share the child’s status with the parents. When a child turns eighteen, parents may wish to discuss with their attorney about obtaining a Health Care Proxy and a Durable Power of Attorney.

Summary

When a child is making their way out of their parents’ home, it can be a dangerous period for the financial wellbeing of both the parents and the child. Insurance agents (and a lawyer), the parents, and the individual leaving home should work closely with one another to make sure everyone is protected appropriately. Education and communication go a long way in this area, and the good news is that the solutions are not expensive.

Left unaddressed, the financial and emotional ramifications of inadequate coverage can be devastating.